Capital Adequacy

Capital Adequacy refers to

the statutory minimum reserve of capital that the bank and financial must have

available. Thus, all the bank and financial institution must maintain the

minimum level of capital as per the NRB directives.

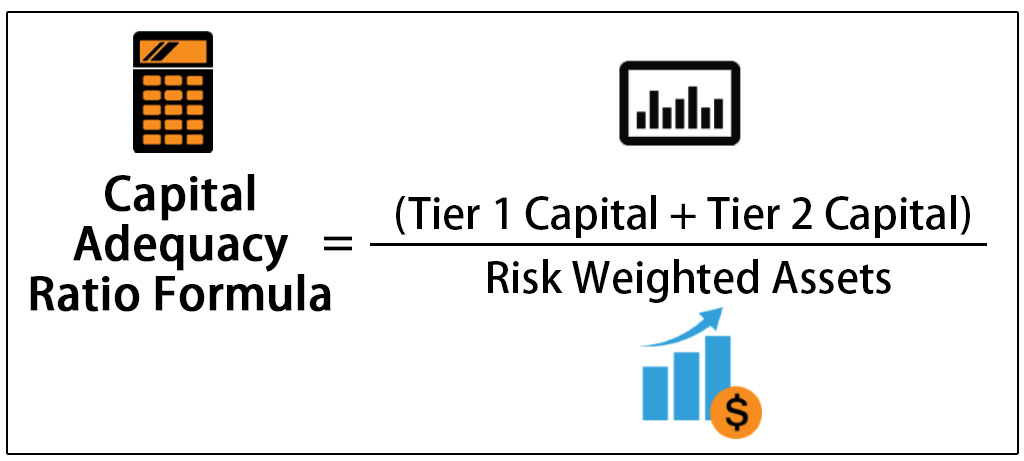

Capital adequacy ratio

refers to the measure of bank capital, which is express in the percentage of the risk-weighted asset. The capital of the bank can be divided into two headings:

Tier I (Core) Capital and Tier II (Supplementary) Capital.

What are Tier I and Tier II capital?

Tier 1 capital is a bank's core capital and includes disclosed reserves—that appears on the bank's financial statements—and equity capital. This money is the funds a bank uses to function on a regular basis and forms the basis of a financial institution's strength. (Investopedia, 2020)

Tier 2 capital is a bank's supplementary capital. Undisclosed reserves, subordinated term debts, hybrid financial products, and other items make up these funds. (Investopedia, 2020)

Capital Adequacy and

Minimum Paid-Up Capital requirements for BFIs:

|

Licensed

Institutions |

Core

Capital (%) |

Total

Capital Fund (%) |

Minimum

Paid Up Capital (Rs.) |

|

Class

‘A’ |

6 |

11 |

8

billion |

|

Class

‘B’ |

6 |

10 |

2.5

billion |

|

Class

‘C’ |

6 |

10 |

1.2

billion |

|

Class

‘D’ |

4 |

8 |

0.8

billion |

Source: Capital Adequacy Framework (2015) & Capital Adequacy Framework (2008)

New capital Adequacy

framework for ‘A’ class Financial Institutions

|

Capital

Adequacy Ratio [X+Y] |

11% |

|

7.25% |

|

A.

Core Capital a.

Equity Capital b.

Retained Earning c.

Share Premium d.

Statuary General Reserve |

4.5% |

a.

Non-cumulative preferred stock b.

Perpetual Debt |

1.5% |

|

1.25%

(can be increased to 2.5%) |

|

2.

Tier 2 Capital (Y) |

3.75% |

|

A.

Undisclosed Reserves B.

Hybrid Instruments C.

Revaluated Reserves D.

Subordinated Debts |

3.75% |

Why is Capital Adequacy Ratio important?

Capital Adequacy Ratio

measures the bank’s ability to absorb the losses and tackle the financial

shocks. Capital Adequacy Ratio determines the capacity of banks to hold the

losses and survive the financial turmoil.

1. Ensuring the solvency of the bank

The capital Adequacy ratio is the measure of a bank’s ability to absorb

the losses that a bank might be exposed to due to risky assets. CAR ensures the

solvency of the bank as high CAR denotes the ability of the bank to absorb high losses

i.e. if tier one capital is high, then the losses incurred of a risky asset can

be absorbed easily.

2.

Restrains the amount of credit creation

CAR according to BASEL III must be maintained 10 percent or more,

that is, every bank must maintain at least a 10 percent Capital Adequacy Ratio.

This implies that the bank should make meticulous care while granting a loan to

the clients as exposure to risky assets decrease the CAR.

3. Credit Exposure

The

capital adequacy ratios are laid based on the credit exposure that a particular

bank has. Credit exposure is different from the amount loaned out. This is

because banks can have credit exposure if they hold derivative products, even

though they have not actually loaned out any money to anybody. Therefore, the

concept of credit exposure and how to measure it in a standardized way across

various banks in different regions of the world is an important issue in formulating

capital adequacy ratios.

4. Multi-Tiered Capital

For the

purpose of calculating the capital adequacy ratio, not all the bank’s capital

is considered to be at an equal footing. The capital is considered to have a

multi-tiered structure. Therefore, some part of the capital is considered to be

more at risk than other parts. These tiers represent the order in which the

banks would write off this capital if the situation to do so arises.

5. Risk Weighting

The capital Adequacy Ratio is calculated as tier one capital plus tier two capital divided by total weighted risk asset. So, the weight of each asset is not equal. The short term borrowings or loan have low risk while long term loans have high risk, therefore, the risk assigned to all the borrowing is not equal.

Thank you very much. You made this concept quite simple.

ReplyDeleteNepali ma padhna paudaina sir?

ReplyDeleteIs it based on NCAF ??

ReplyDeletePost a Comment