Negotiable instruments mean a written document which creates a right in favor of some person and which is freely transferable. Although the Act mentions only these three instruments (Such as a promissory note, a bill of exchange and cheque), it does not exclude the possibility of adding any other instruments.

Negotiable Instruments, its Party, Rights, and Liabilities as per Act

- Ambiguous Negotiable Instrument: Where a Negotiable Instrument may be construed either as a Promissory Note or Bill of Exchange the Holder may at his /her election treat it as either.

- Rights of the Holder: The Holder may transfer the Negotiable Instrument.

- Negotiable Instrument without Payment Date: Payment of the Negotiable Instrument in which the payment date is not written shall be made on-demand.

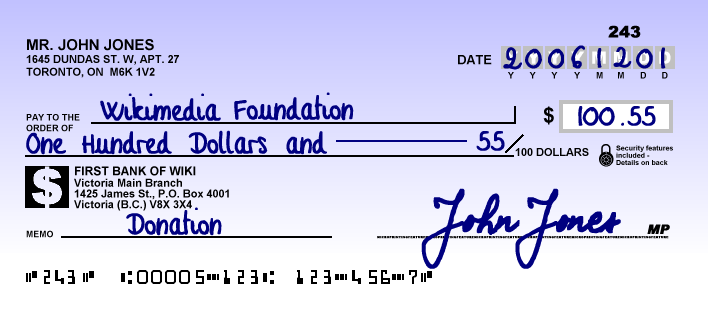

- Difference between Figure and Letter: In case there is the difference between the figure and letter of the amount to be paid on the Negotiable Instrument, the amount written in the letter shall be the amount to be paid.

- The Additional Time Limit: Payment of the Negotiable Instrument on which it is not written that payable on demand or at sight or on presentment shall be on the fourth day from the date of payment.

- Payment after the Specified Period: Payment of the Negotiable Instrument payable on a specified day or after the specified period of presentment or after the happening of any inevitable event or after the specified period of the happening of such event shall be as mentioned in such instrument.

- Calculation of the Date of Maturity: While calculating the date of payment of the Negotiable Instrument to be payable after a specified period, it is calculated by excluding the day written in the Negotiable Instrument or the day of presentment for the acceptance.

- When Day of Maturity is a Holiday: When the day on which a Negotiable Instrument is at maturity is a Public Holiday, the instrument shall be deemed to be due on the next preceding business day.

- The capacity of Parties: Any person, who is capable of contracting under the prevailing law, may make, draw, accept, endorse, negotiate, etc. of the Negotiable Instrument and all parties shall be liable for it. Provided that, if such an act has been done by the minor, all parties accept him/her shall be liable.

- Agent: For the acts done by an agent, the principal who has authorized him/her to do such act shall be liable.

- Liability of an Agent: If an agent who signs his/her name to a Negotiable Instrument without indicating thereon that he/she signs as an agent, or he does not intend thereby to incur personal responsibility, is liable personally to such Negotiable Instrument.

- Liability of an Heir: If a person who signs his/her name to a Negotiable Instrument as an heir of a deceased person is fully liable personally thereon unless he/she expressly limits his liability to the extent of the assets received by him as such.

- Liability of Drawer: In case the Drawer has been provided due notice of dishonor of the bill of exchange by the acceptor or Drawee, it shall be the duty of the Drawer to Compensate the Holder.

- Liability of the Bank Giving Payment of the Cheque: The Bank having sufficient funds of the Drawer in the account, properly applicable to the payment of the Cheque must pay the Cheque, and, in default of such payment must compensate the Drawer or Holder in due Course for any loss or damage caused by such default pursuant to this Act.

- Liability of Maker of Promissory Note and Accept or of the bill of exchange: The maker of a Promissory Note or the acceptor of Bill of Exchange is bound to pay the amount thereof at Maturity when the Negotiable Instrument is duly presented for the payment. In default of such payment, the maker of the Promissory Note or the acceptor of the bill of exchange is bound to compensate any party payable for any loss or damage sustained by him and caused by such default.

- Liability of Endorser: Any person who endorses and delivers a Negotiable Instrument expressly limiting or excluding his/her own liability, shall be responsible to every subsequent Holder except otherwise a contract is made thereto.

Liability of the Parties to Holder in Due Course: Every prior party to a Negotiable Instrument is liable thereon to a Holder in due course until the instrument is duly satisfied.

Source: https://en.wikipedia.org/wiki/Cheque

Source: https://en.wikipedia.org/wiki/ChequeLegal action for misusing promissory note including cheque

How can a cheque be misused? Misuse by the drawer or maker- Amount in cheque exceeding the balance available in drawer’s

- Intentionally making mistake in writing cheque

- Writing a cheque of another person by imitating the signature

- Signing a blank cheque

- Manipulation in cheque amount

- Imitating the drawer’s signature

- Bearer of the cheque not being the actual payee (if the cheque is lost)

How can a Promissory Note be misused?

Misuse of Promissory Note by Drawer or Maker

- Fake collateral

- Fake documents

- Intentionally reducing the loan amount while writing a promissory note

- No intention to repay the loan

- Fictitious company

Legal Action of Misusing Cheque

On receiving the complaint, along with an affidavit and relevant paper trail, the court will issue summons and hear the matter. If found guilty, the defaulter can be punished with a monetary penalty which may be twice the amount of the cheque or imprisonment for a term which may be extended to two years or both. The bank also has the right to stop the cheque book facility and close the account for repeat offenses of bounced cheques.

In the case of any person who deliberately issues a cheque to somebody that he/she does not bear deposit in the bank or there is an insufficient deposit in a bank to honor the cheque, then such an act is deemed to be an offense. Such offense is fined up to Rs. 3000 or three months of imprisonment or both.

Post a Comment